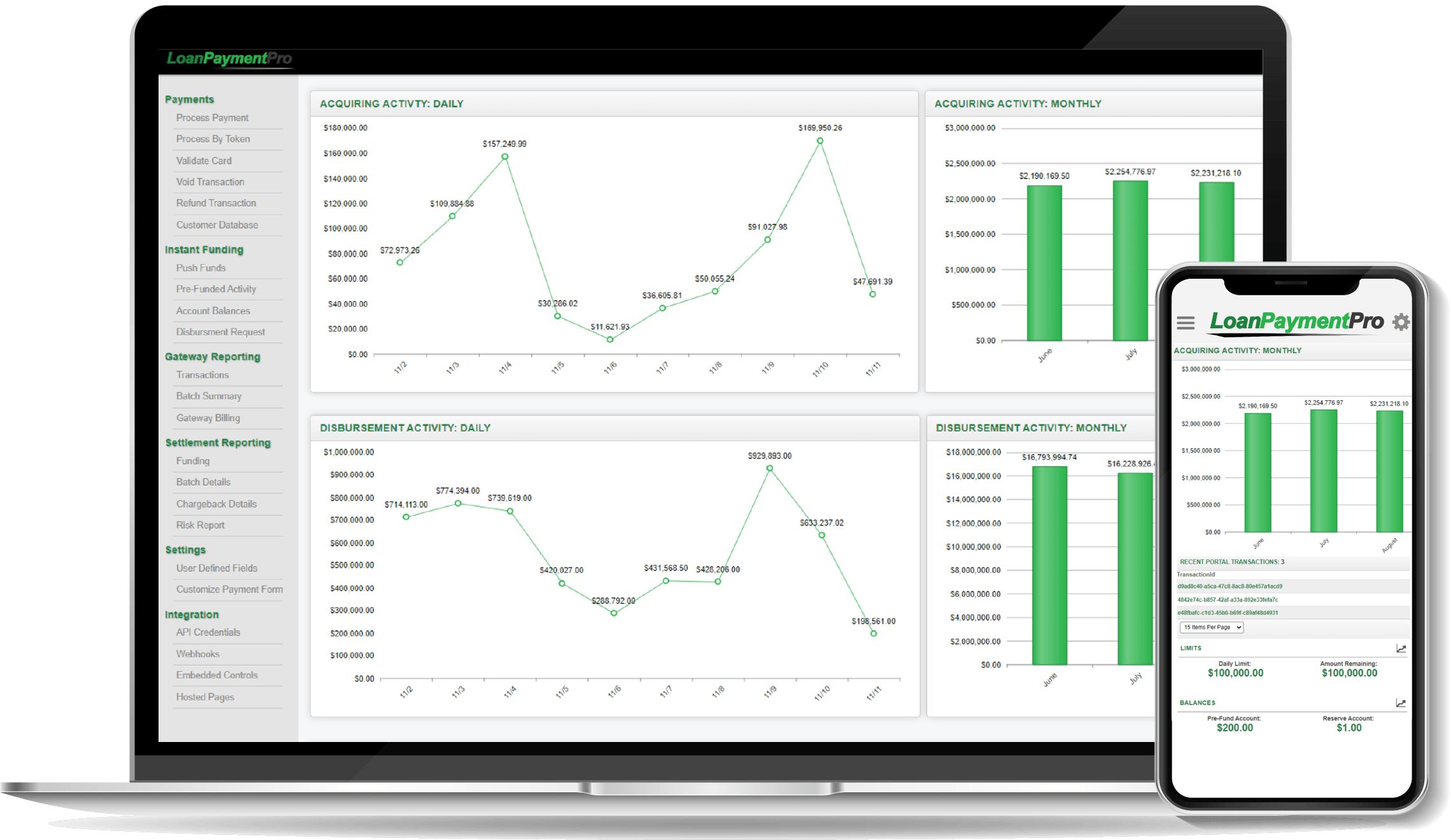

LoanPaymentPro’s innovative loan servicing system makes it easy, secure, and affordable for you to provide the convenient payment processing options that today’s borrowers demand.

LoanPaymentPro is a revolutionary merchant services and technology firm providing debt repayment and fund disbursement exclusively for the consumer lending industry.

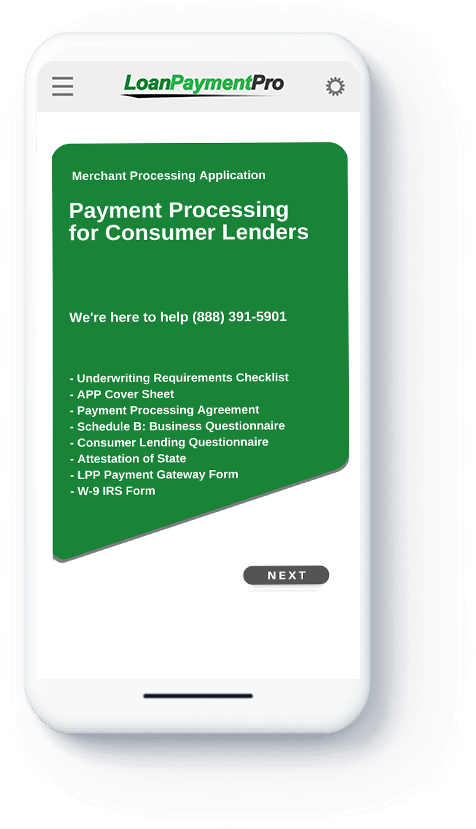

Developed using proprietary, patent-pending technology, ours is the only compliant and cost-effective bankcard, ACH, and RCC/Check21 acceptance platform for both state-licensed and non-state-licensed lenders, brick-and-mortar lenders, P2P, marketplace platforms, and online lenders.

The nature of the lending industry has changed significantly over the past decade, as has the nature of borrower payment needs. Short-term and small-dollar-loans, including installment loans, peer-to-peer, online and marketplace loans generate more demand every day. Meanwhile, the type of repayment methods that borrowers use have also expanded to include pre-paid cards, payroll cards, gift cards and more.

While loan profiles and repayment needs have changed, compliance requirements and merchant servicer options have failed to keep pace – until now.

Minimize your fees and fraudulent payments, maximize your repayment acceptance rate, and ensure PCI compliance with LoanPaymentPro.